In property estate, timing is everything.

Timing your choices to purchase and sell property is the way to boosting benefits. Specialists typically do as such by contemplating the changes of costs inside the land cycle.

Regardless of whether you are a mortgage holder, financial specialist or a tenant, it is imperative to see how the property cycle functions so as to benefit as much as possible from your property.

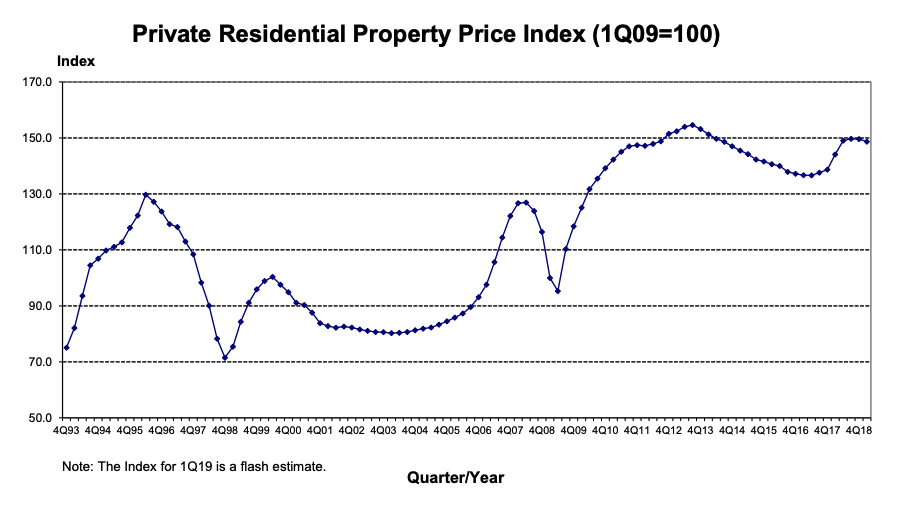

A few specialists contend that there is no such thing as property cycles. Truth be told, by just taking a gander at the property value file chart, it is difficult to derive that there is a predictable and normal cycle set up.

In the previous 10 years, Singapore’s private property costs have been on the ascent. Despite the fact that it has diminished from 2014 to 2017, we can see that the costs from 2014 to 2018 are as yet higher than anything previously.

Curiously, we see that these qualities will in general ascent in waves. In certain quarters, there is solid development while in some there is moderate development or even a dive.

This is somewhat like the chicken and egg question. All things considered, it is a cycle, isn’t that so? So how could it begin?

Normally it starts with populace development, a straightforward purpose behind an expansion sought after. At the point when request increments, normally, costs of houses begin to increment. Both rental costs and new homes will begin to get increasingly costly.

For some, they are purchasing new homes. For financial specialists, this resembles a decent time to purchase property, as costs appear to expand, which means they can sell the property at a more expensive rate later on.

Gradually, this boosts designers to manufacture more property and for new engineers to start development attempts to satisfy this new need.

In any case, a run of the mill townhouse advancement takes around 2 years to be grown, so we can say that the supply of land is extremely inelastic.

Generally, numerous engineers bounce ready and cause an oversupply of property. At the point when there are more accessible units than purchasers, costs begin to drop. We can watch this on account of Singapore, where property costs have been falling since 2014.

At the point when costs fall, numerous financial specialists sell their property on the off chance that they anticipate that it should fall further. This infuses more supply of property in the market, and costs and rentals keep on dropping. They might possibly tumble to as low as before its crest before getting once more.

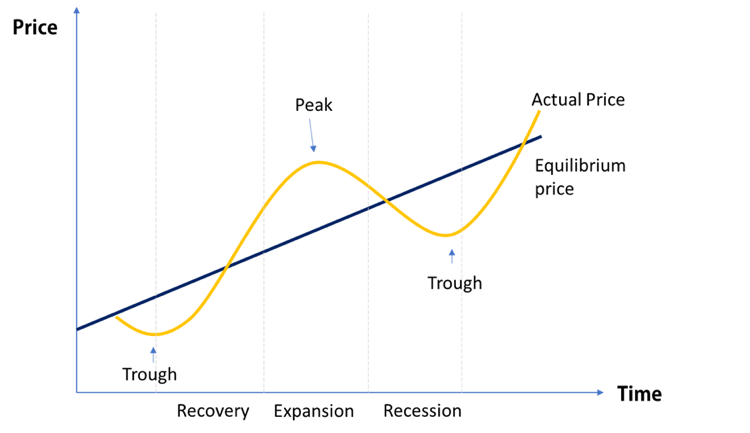

The above chart demonstrates a general increment in cost of houses, while the genuine costs increment in waves. The periods of a property cycle are – Recovery, development, pinnacle and subsidence and trough.

Recuperation – Usually, when the land market is recouping, request is moderate. There are a couple of pointers that demonstrate that the market decay is arriving at an end.

These patterns are commonly demonstrating an expansion sought after, for example, increment in property viewings, or abatement in opening rates.

Given that this stage is difficult to recognize, financial specialists who presume a looming recuperation should purchase property as of right now for solid returns in the up and coming extension stage.

Development – During this stage, land costs will increment quickly. It is additionally regularly known as the ‘blast’ stage.

As investors and homebuyers gain trust in the rising lodging costs, they will in general push up the interest by purchasing up significantly more houses.

This stage is generally joined by a developing economy and production of more occupations. Rents begin rising and opportunity rate diminishes.

Right now, numerous designers revamp and remodel old property to exchange it in the market, so as to profit by developing rental and property costs.

Peak – As financial specialists and purchasers drive up costs, as referenced previously, development grabs and the cost increment begins to back off.

Specialists esteem this point as the best time to sell your property on the off chance that you don’t plan to keep it past the following cycle.

We can distinguish a top with these qualities:

Property costs have risen reliably for various quarters

Property exchanges have expanded

Abnormal amounts of obtaining to purchase property

Lodging gets more expensive

Government cooling measures

Large amounts of development

The above information can normally be found on URA’s site or in many web articles that give year-on-year insights on property costs and opportunities.

Retreat – During this stage, costs begin to diminish. This can be because of different factors, for example, oversupply and property cooling measures. Property speculators gradually pull back from the market.

As costs diminishing, an ever increasing number of individuals begin selling their property at dread that costs may drop further.

Qualities of this stage are: Increasing opportunity rates, dull interest and falling rents.

Trough – This is the absolute bottom of the land cycle. For the most part there are inconspicuous indications of recuperation and financial specialists who can recognize this stage will be liberally remunerated for going for broke in a property downturn.

The standard guideline is that we ought to dependably purchase low and sell high. This implies we should purchase property when the cycle is at its trough and sell them at its pinnacle.

Nonetheless, it is difficult to separate which part of the cycle the property market is at on the grounds that it is difficult to foresee future costs, and information gave on the web probably won’t be forward-thinking.

Another reason is that the cycles are regularly upset by flighty outside components and one significant factor is cooling measures by the Singapore government.

The cooling measures acquainted since 2013 were executed with “keep cost increments in accordance with monetary essentials”.

To put it straightforward, the government needs to keep the property costs steady and feasible.

The cooling measures incorporate the Additional Buyer Stamp obligation rates presented very nearly a year prior. With Exceptions to Singapore Citizens, and Singapore changeless inhabitants acquiring their first private property, the ABSD rates have expanded 5% over the remainder of the gatherings of people. There was a 10% expansion for organizations purchasing properties.

| Rates on or before 5 July 2018 | Rates on or after 6 July 2018 | |

| SCs buying first residential property | 0% | 0%(no change) |

| SCs buying second residential property | 7% | 12%(revised) |

| SCs buying third and subsequent residential property | 10% | 15%(revised) |

| SPRs buying first residential property | 5% | 5%(no change) |

| SPRs buying second and subsequent residential property | 10% | 15%(revised) |

| Foreigners buying any residential property | 15% | 20%(revised) |

| Entities buying any residential property | 15% | 25%(revised)Plus, additional 5% for developers |

Source: MOF

This expansion in duty payable will hinder financial specialist take up of property. We can accept this as a decent pointer that costs will stay hearty and the expansion will begin to back off.

Basically, on the off chance that you are quick to purchase or sell property, it is constantly essential to see where the market is on the property cycle, just as to peruse up on news on up and coming supply, request and cooling measures so as to capitalize on your deal or buy.

© 2023 Realstar Premier Group Pte. Ltd.